Clean up old photos, remove watermark or other unwanted objects or do a little touchup here and there to produce a perfect picture out of an ordinary snapshot. SoftOrbits Photo Retoucher can perfect your photos, making you want to frame them and hang on a wall. Here's how.

garantie

ver. 6.1

RickyThis is very good for removing unneeded objects (or persons) from photos. It is simple to use and gives good results.

Brian KeiranThe only think I can say: I like to have such a wonderful program to be the envy of all my friends and families.

Arron BodenThis photo restoration software is ideally suited for rejuvenating vintage photos. Old photos have crease, cracks and other defects. Read more...

Photo Retoucher is an easy to use software that can return your old photos back to life. This tool is easy to use and can do old photo restoration tasks for your photos. When you scan them your old photos can be damaged, scratched, have spots and dust. You would like to restore old photos of a family and put it into the frame or put it into your album. This software can easily make it possible.

Be it a landmark or a portrait shot, it's often impossible to take a clean, unobstructed picture of a subject. An occasional tourist or branch, cut-off passerby, moving or parked cars, obstructing heads, hands and legs can ruin an otherwise stunning shot. Unless you're shooting noire, the ever-present garbage bins don't usually enhance shots either.

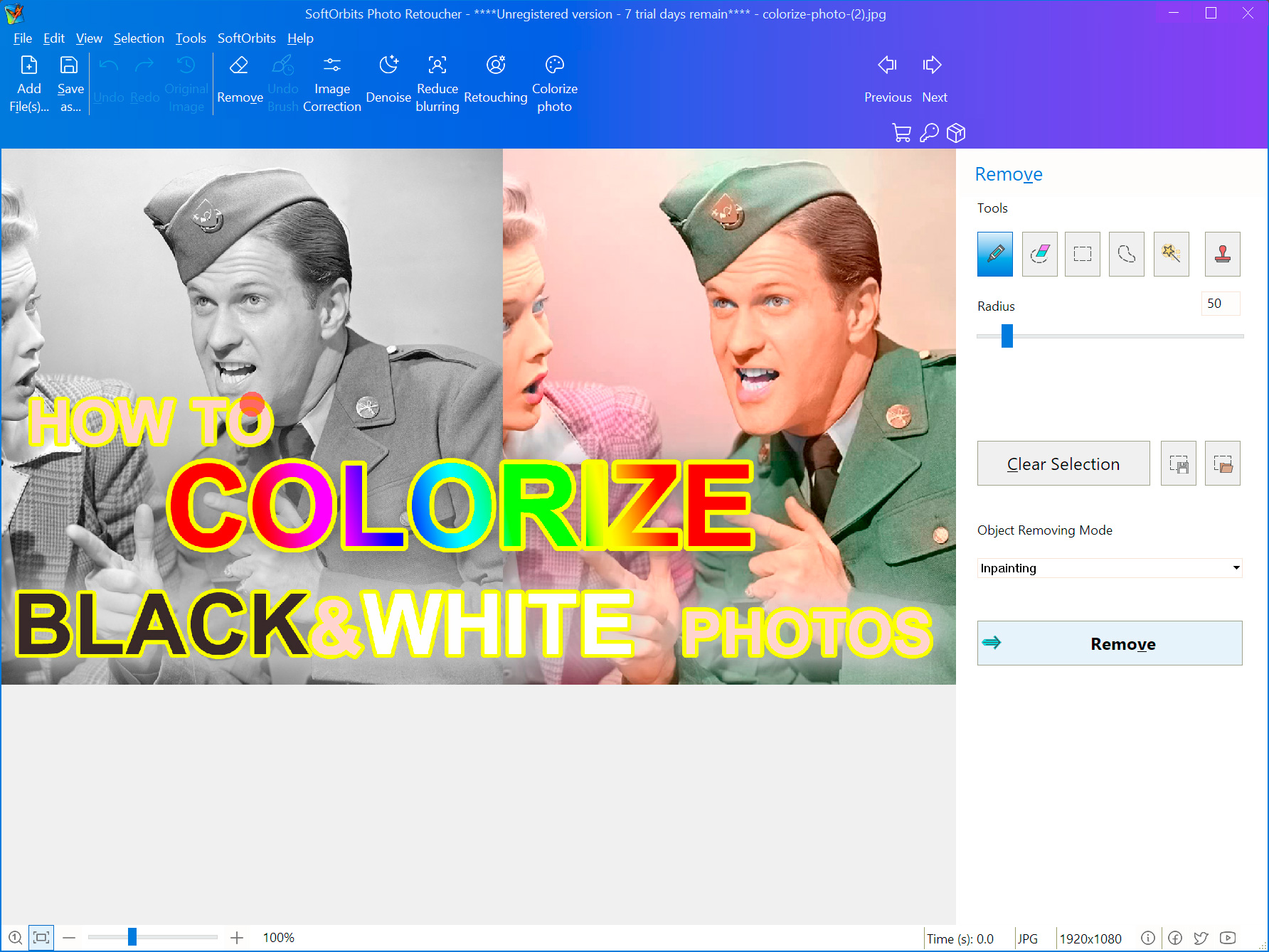

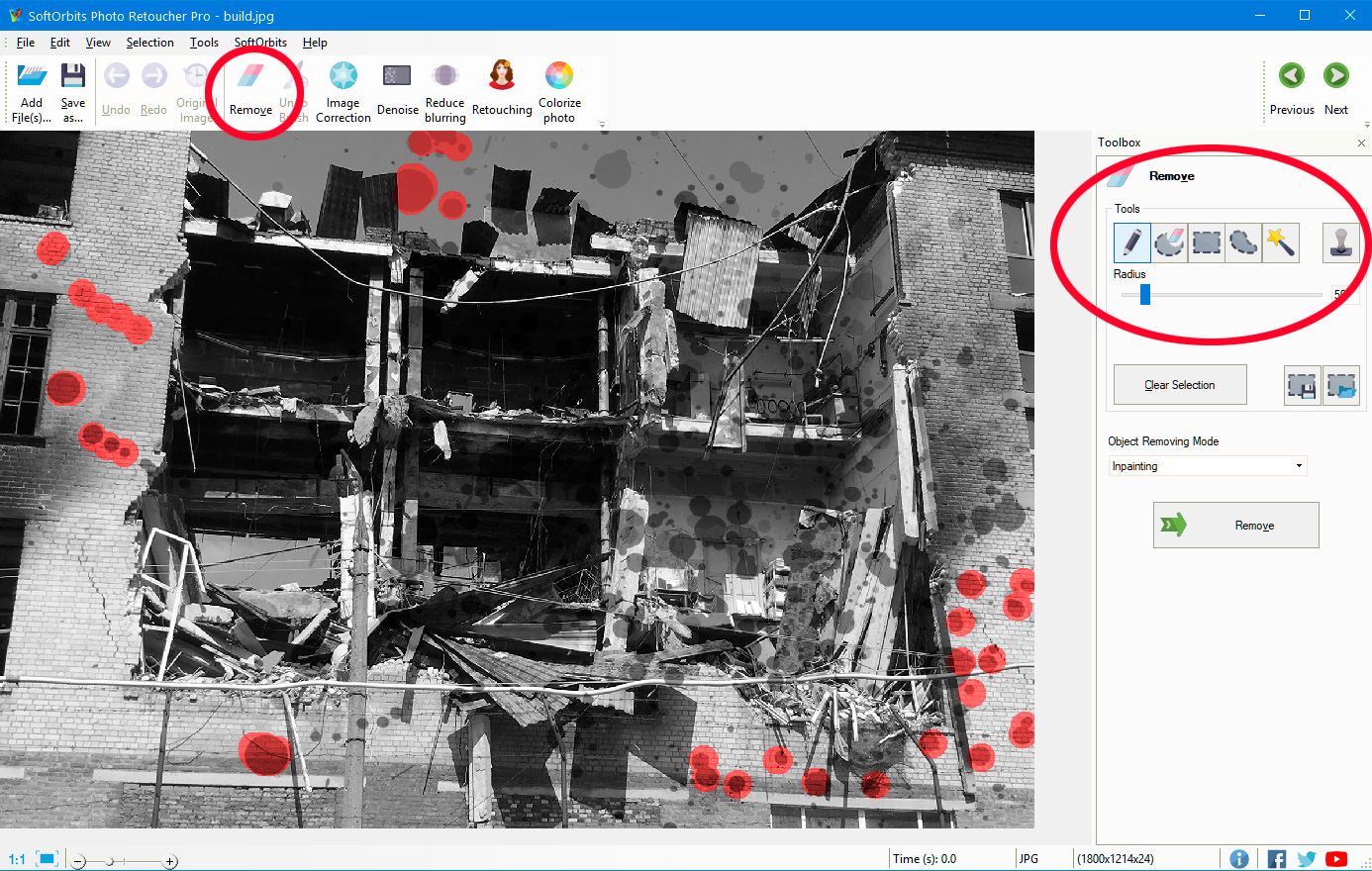

With SoftOrbits Photo Retoucher you can easily and seamlessly remove distracting objects from your photos without a trace. Newly developed smart content-filling algorithms will analyze your image and reproduce the original background behind the object being cut out. It's hard to believe but it works wonders. Check out these two snapshots:

A picture on the left is unprocessed. The right photo was retouched by SoftOrbits Photo Retoucher with unwanted objects removed and background automatically restored.

With SoftOrbits Photo Retoucher, removing skin imperfections and retouching portraits is wonderfully easy. We don't believe in glamour so we won't make your significant one look like a plastic doll, but small things like scars, pimples or freckles can be cleaned up nicely and without a trace. Check out the following pair of snapshots. Which one is a better portrait?

SoftOrbits Photo Retoucher can make teeth and eye balls whiter, remove dark shadows and give portraits a smoother look.

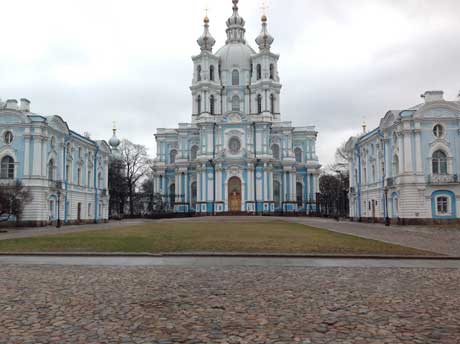

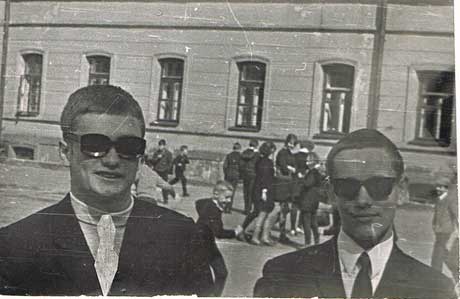

Restoring old, damaged photographs can be a time-consuming photoshopping experience - or a quick edit with SoftOrbits Photo Retoucher. The tool can detect and remove dust, scratches, cracks and other imperfections from scanned prints and negatives. Smart content-aware algorithms automatically restore missing parts of the image, filling imperfections to make them disappear without trace. Here's how a restored photo can look like:

SoftOrbits Photo Retoucher can remove scratches and spots, clean up film grain and digital noise, reconstruct cracks and damaged areas, and erase marks and writings from your photos in just a few clicks.

You can download the evaluation version of SoftOrbits Photo Retoucher free of charge.

Photographs are precious memories of the past that replay the lovely moments spent with our friends and family. Most people have huge collections of pictures arranged in a photo album, or piled up in a cupboard or an old trunk.

In earlier times, people had to follow long procedures to click pictures and then get a hard copy of the same. There was no luxury of saving photographs in the memory card or a digital device.

While discovering an old box full of beautiful photos can strike up nostalgia and make you feel like you found a hidden gem. But as you start looking at them closely, a bit of disappointment may also be there because of the damage that you see on the pictures.

Fortunately, the digital solutions have totally revolutionized the way we looked at photographs. Now, we can improve the way an image looks, make the changes according to our choice, and the best part is restoring old photographs has become a lot easier than we could ever think.

Don't lose hope, and make the most use of technology! Let's have a look how you can make old photos look lively again.

Just like any other piece of paper, the ink of the images fad and the quality deteriorates over time. If people want to go through them in the present, all they'd have is a picture with scratches, torn edges, stains, and more.

Now, being in the technologically advanced era, it has become easier to restore old photos with plenty of software available online.

Are you excited about repairing old photographs with software?

A collection of old photographs aren't just random images, rather they're sweet moments and memories in the form of clicks.

If you want to bring your old damaged photo(s) back to life, then you can easily do that with the ultimate software - Photo Retoucher. Sophisticated, innovative, and easy to use, it can be an ideal solution to restore pictures and relive the good old days.

The software is creatively designed to make the photo restoration process straightforward, convenient, and quick. Plus, there's no expertise required to use this superb solution. It can be beneficial for you in a variety of ways including the following.

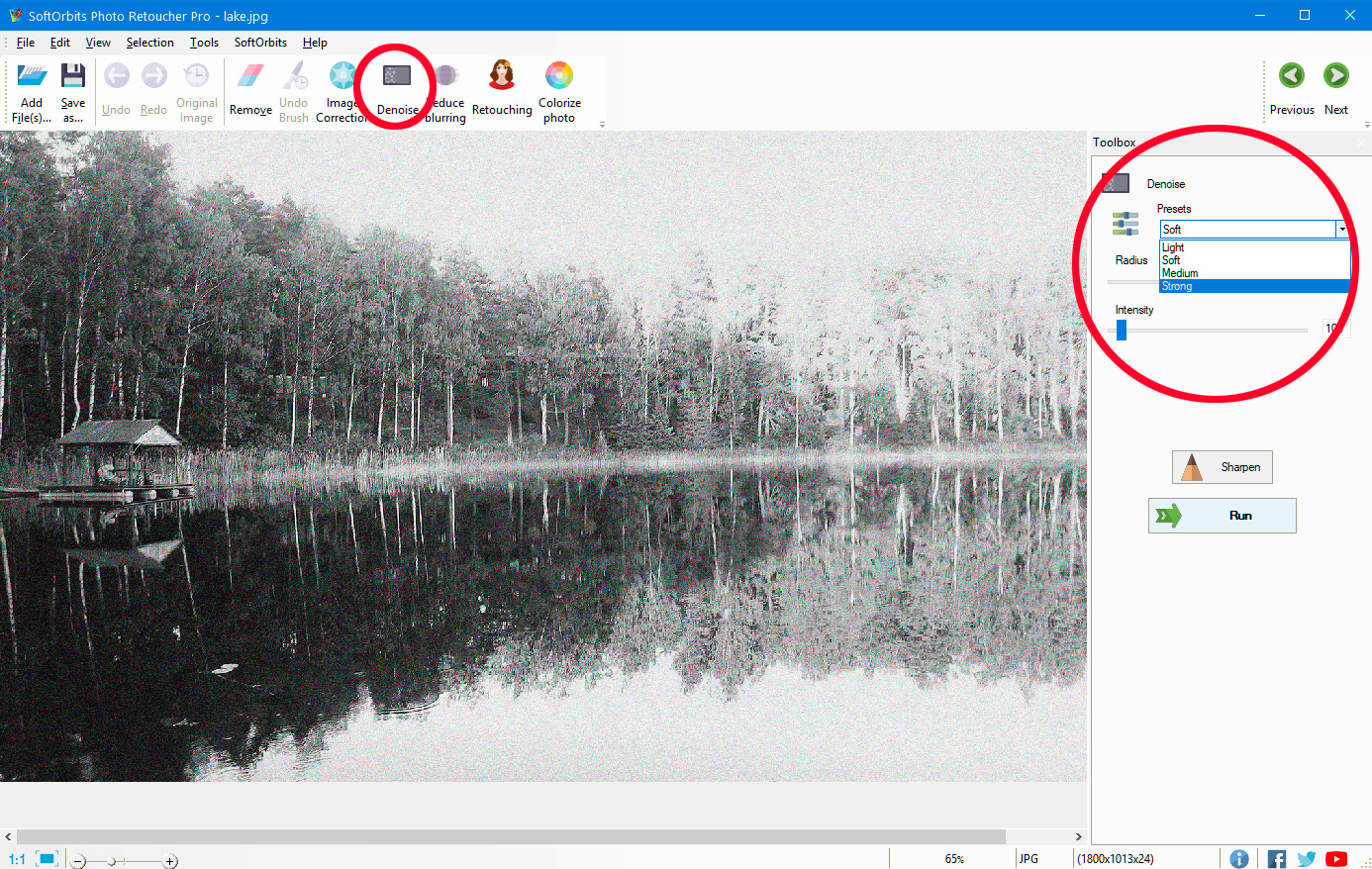

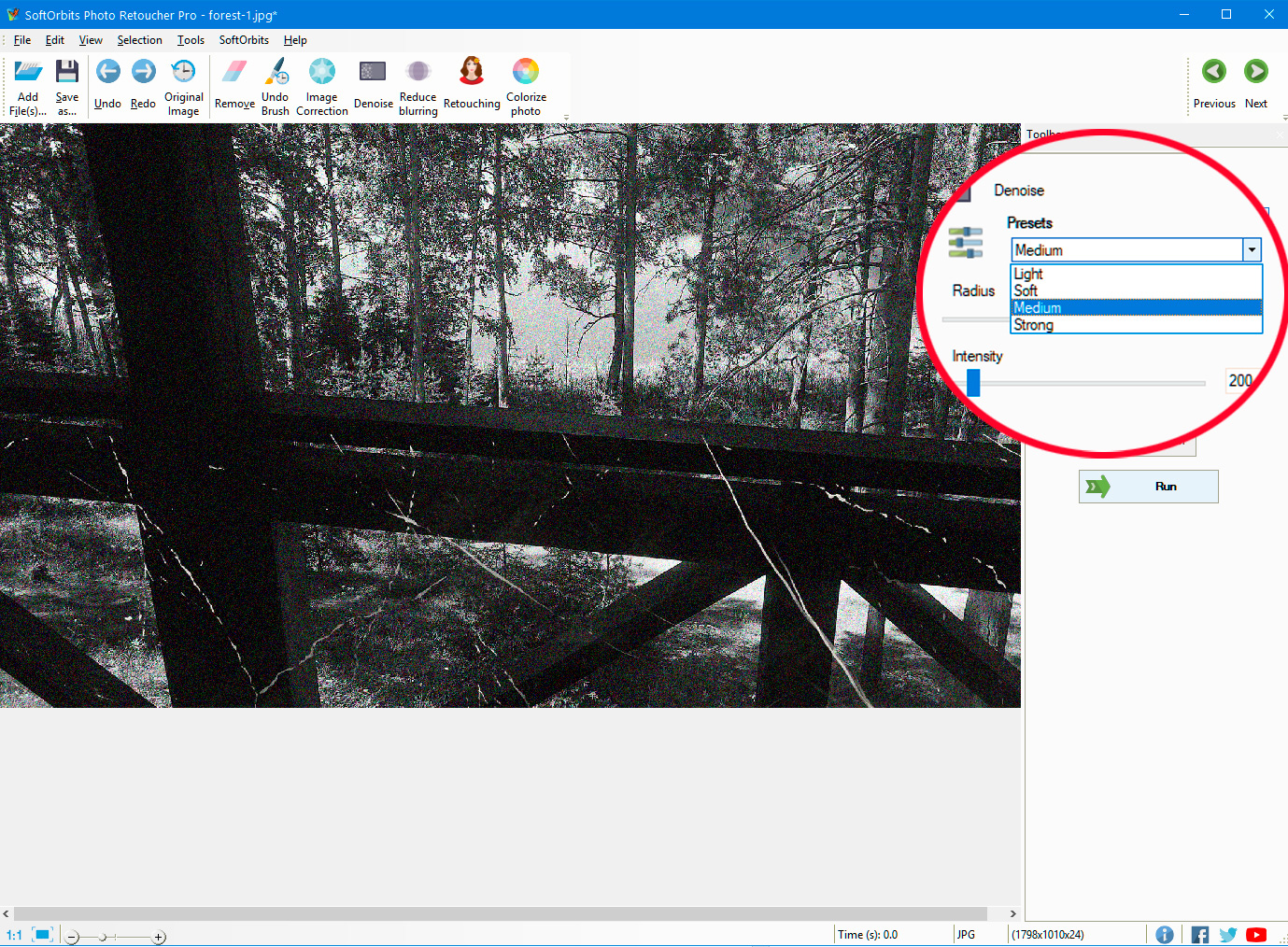

You'd like to make your pictures look beautiful and fresh, and for this you'd want to make improvements to the grainy background. This can be easily fixed with Retoucher. Plus, if your images are a little blurry, you can use the «Blurry photo fixer» feature to make your pictures look clear.

You can choose between the two options for filter strength - remove noise automatically and remove the blur automatically.

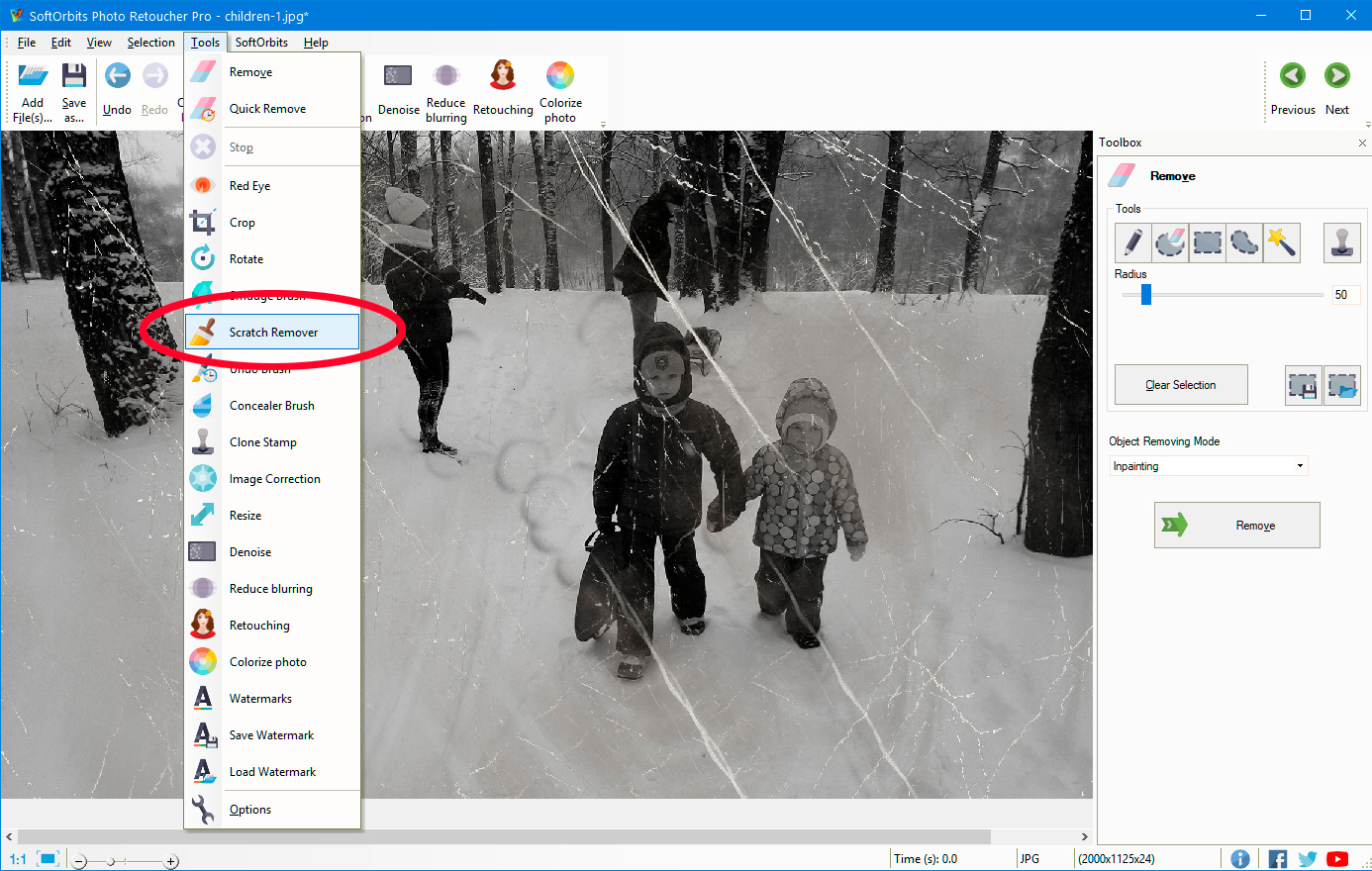

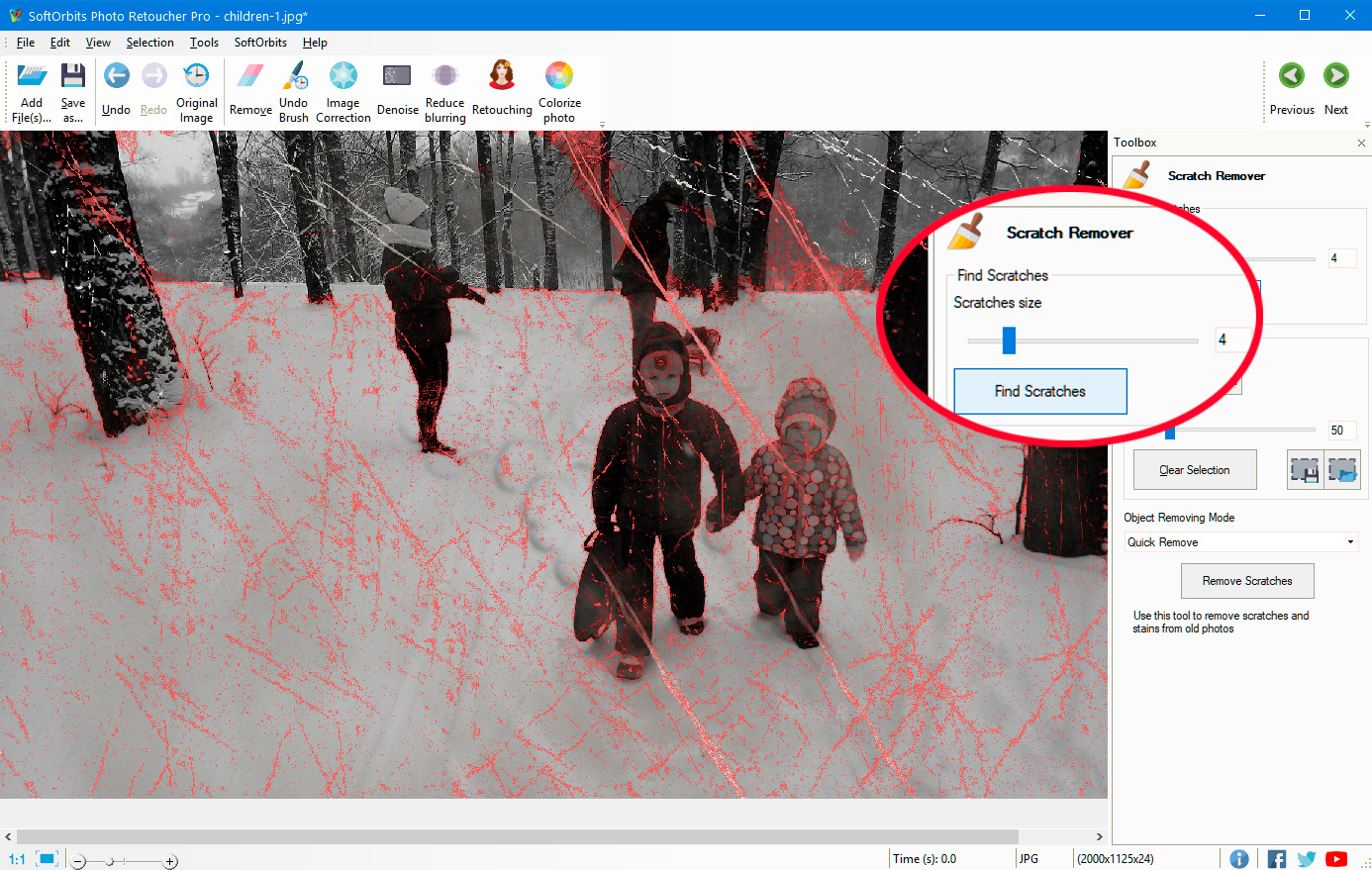

Scratches are the most common things in old photographs. But don't worry; your pictures can be scratch-free with this software. allows the users to make their pictures look fabulous and new.

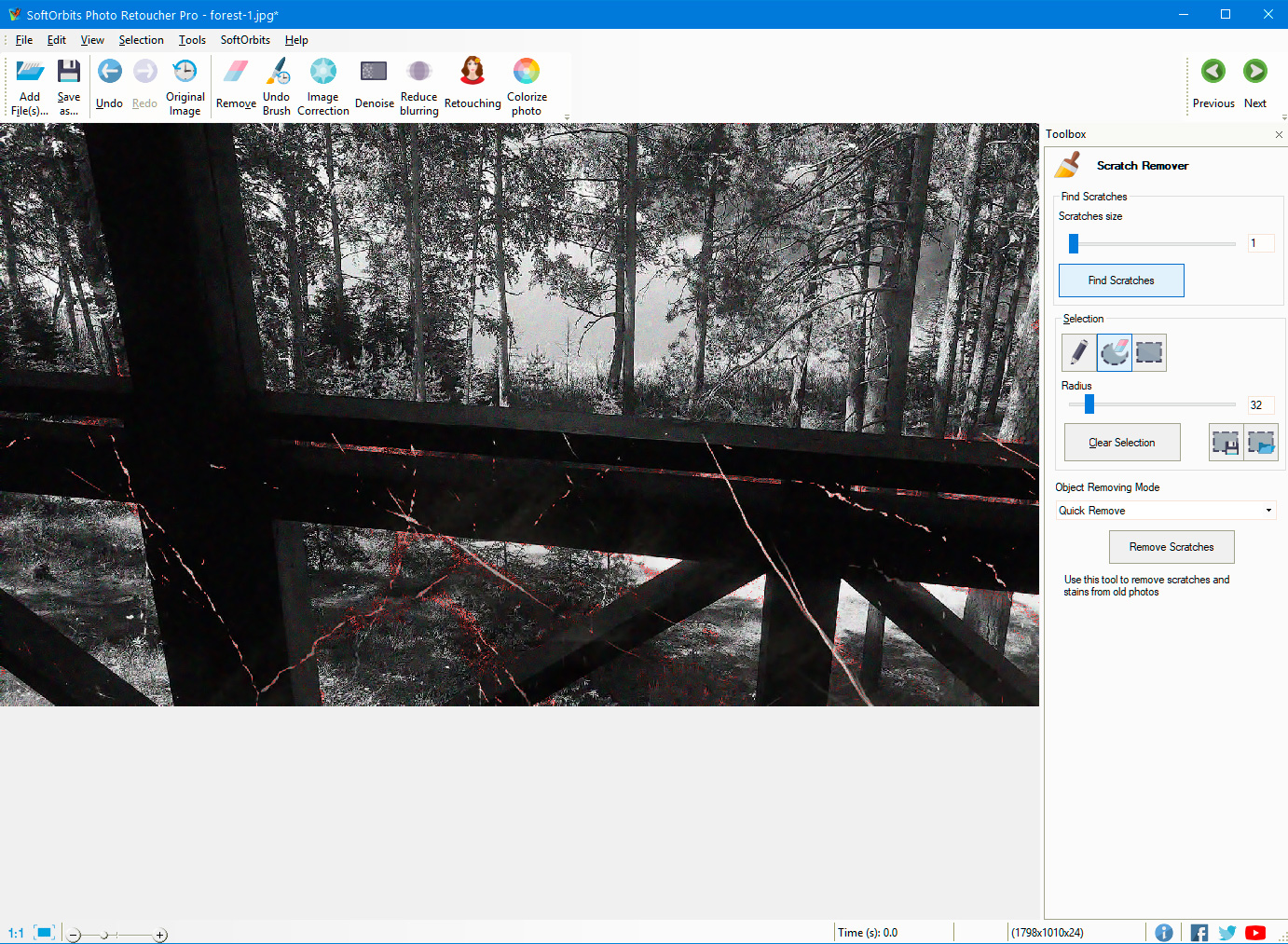

All you have to do is fix the pixels and follow the steps mentioned below:

• Set the size of the scratch.

• To automatically locate the scratches, click the «Find scratches» button on the software.

• Click the Remove button to get rid of the scratches.

Photo Retoucher allows the users to remove the spots and dust from the old photographs effortlessly. There are different tools including Clone Stamp Tool, Smudge Tool, and Concealer Tool, that can be used to make your damaged images look flawless.

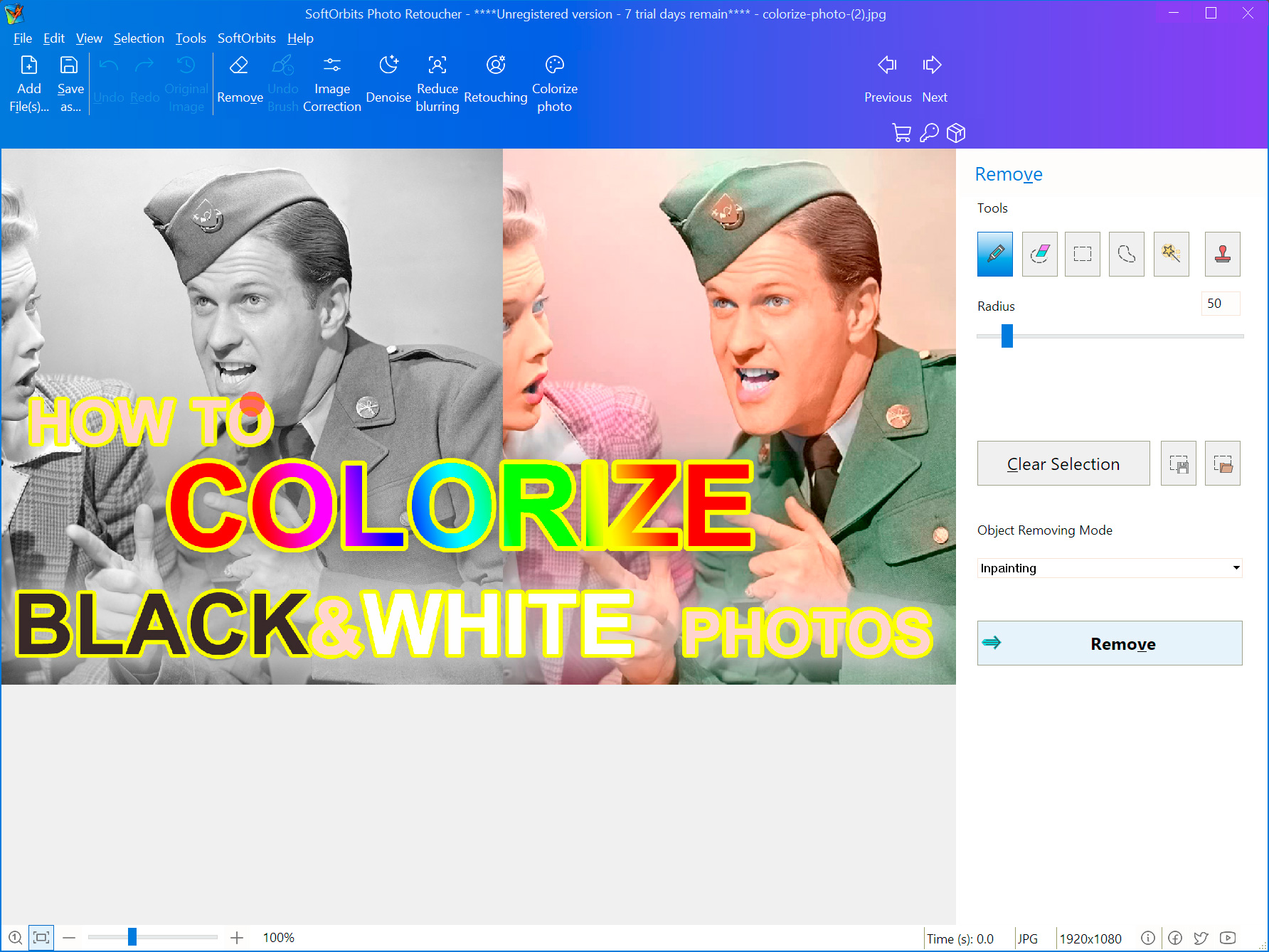

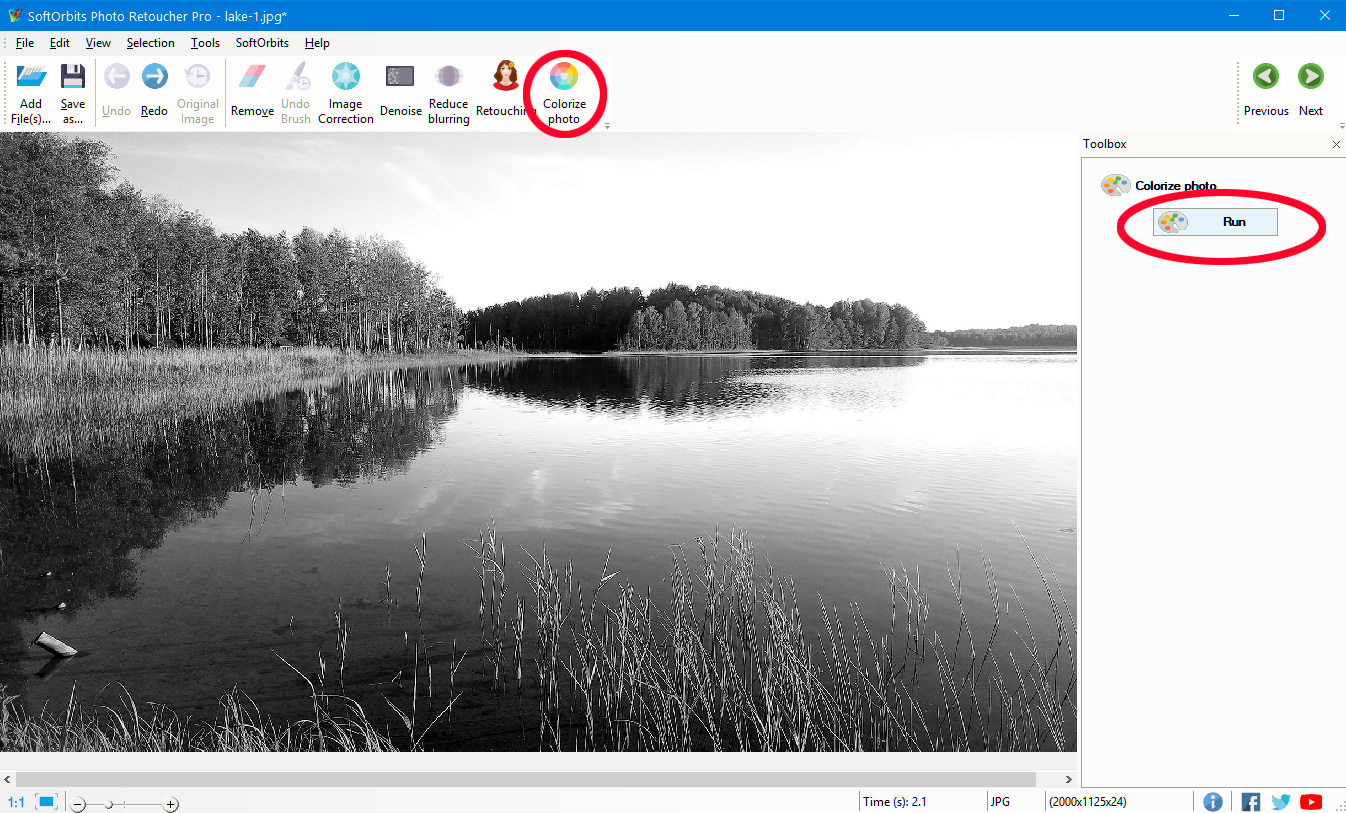

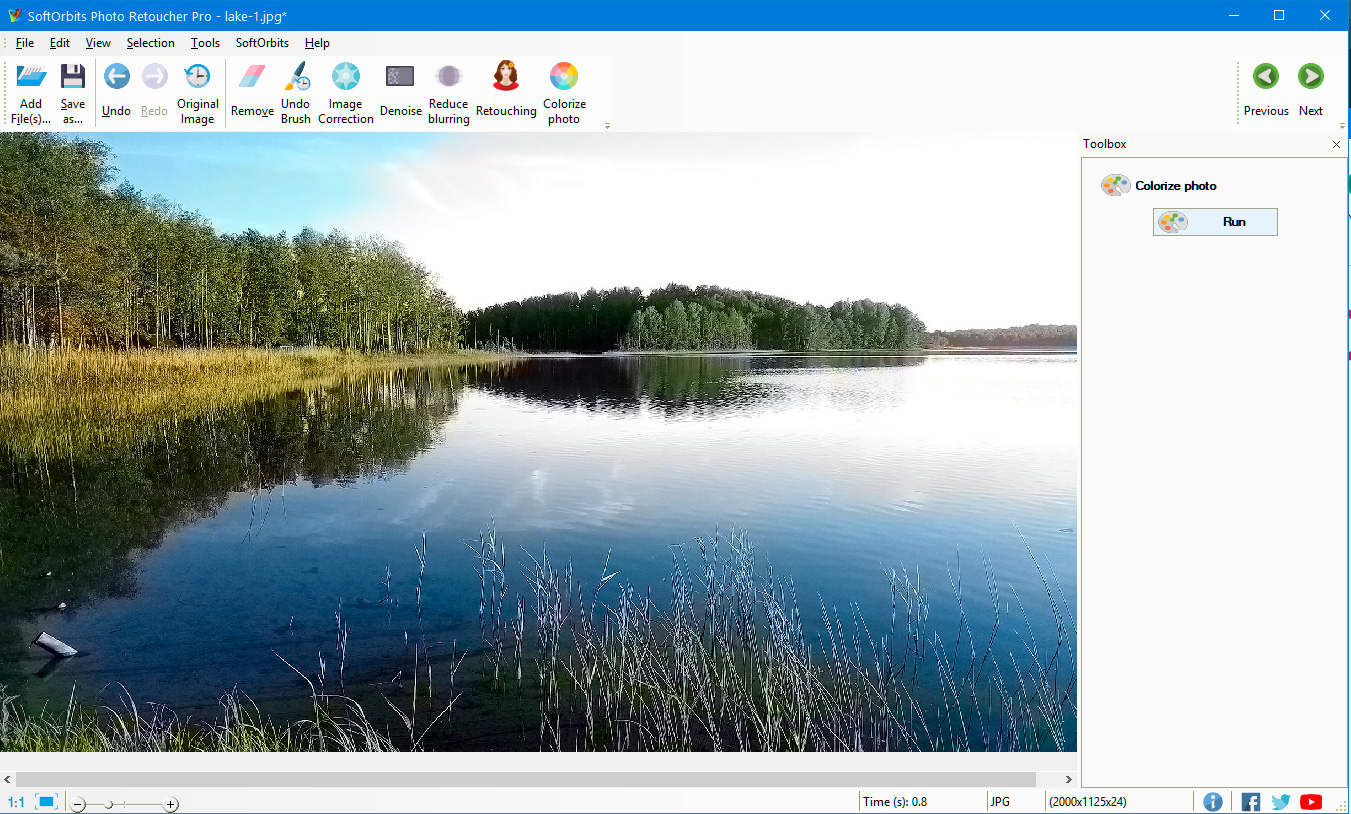

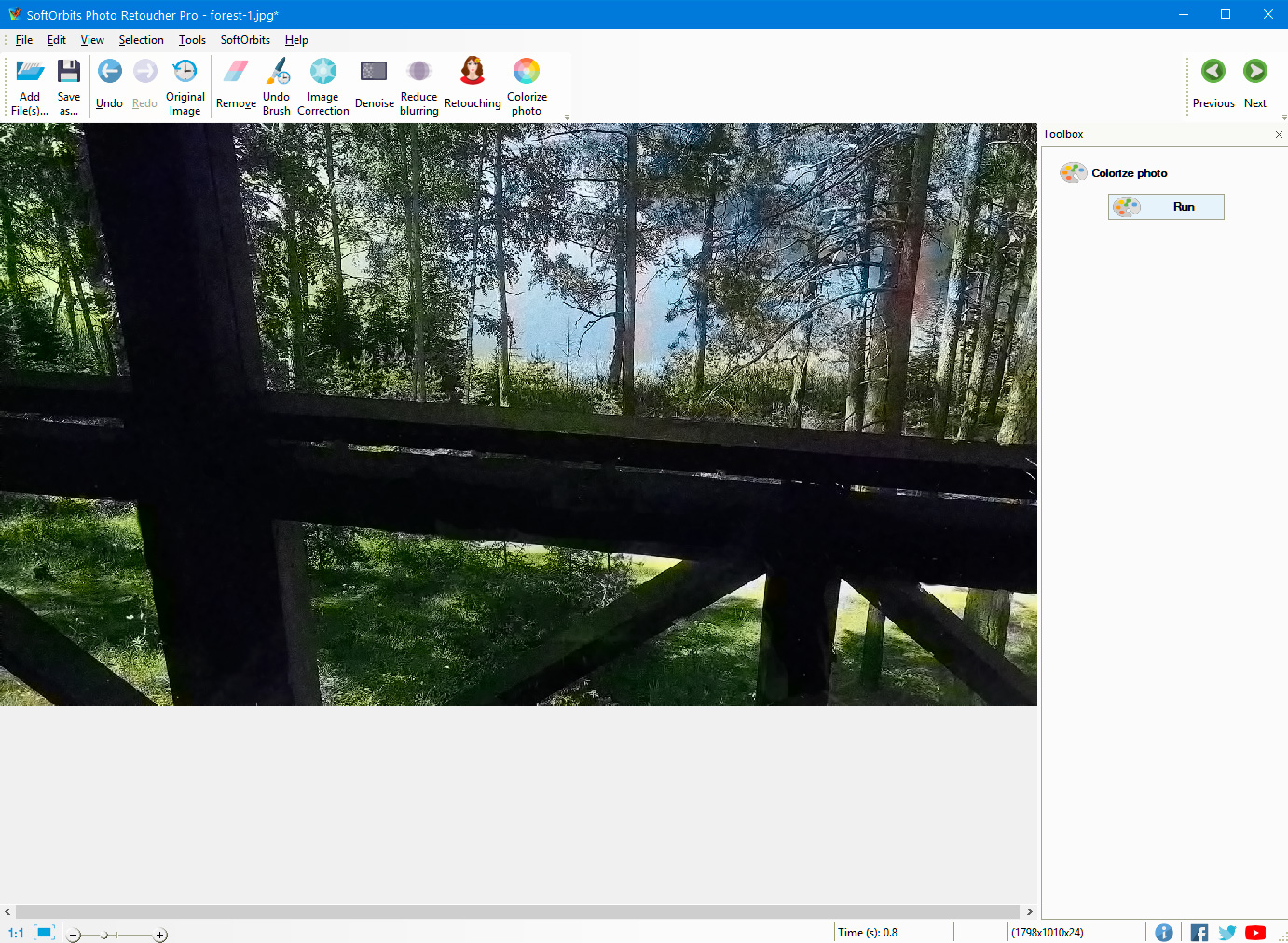

Colors change the entire vibe of an image. Colorizing your black and white photograph will make it vibrant and lively. Also, you'll have clarity of the surroundings and background.

With this powerful software, you can make your images colorful in a very short time. You can simply upload your old black and white pictures and look at the results by selecting the «Colorize Photo» solution and then clicking the «Run» button.

If you're still not sure if this is the right software for restoring old photos, here are some feedbacks.

»I'm so happy that I have my picture of my great-grandmother restored. I thought it was easy to use this software. Thank you !»

»I had an old photo that was grainy and had spots that had faded. Photo Retoucher brought it back to life when I ran my photo through the program»

»This program is so easy to use. I was able to upload my photos and click a few buttons to restore them and make them in color»

Restoring old damaged photos with the robust Photo Retoucher Software is an uncomplicated process. Are you wondering how to clean old photos without any knowledge and experience?

Just sit back, relax and have a look at this detailed photo restoration tutorial.

The first and foremost step to make your old photos look amazing again is to convert them into a digital form by scanning. For this you can use a regular photo scanner or your smartphone's camera or a digital camera, whichever is convenient.

Make sure the image has 400-600 DPI, maximum color depth, and then you can save it as a jpeg or TIFF file onto your computer.

Once the photograph is saved you can upload it to the software by clickinglick the «Add File» or «Add Folder» option.

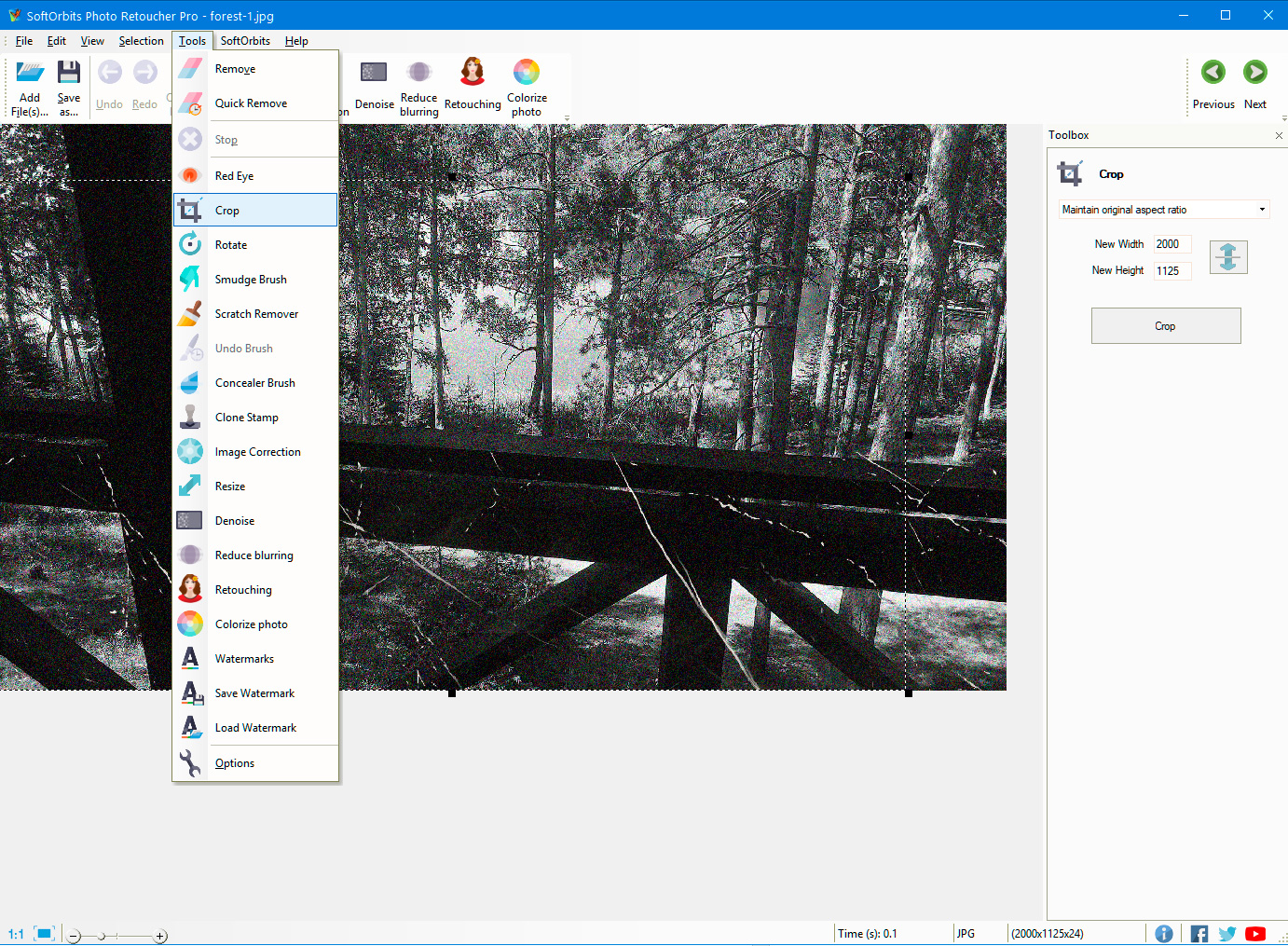

If there are any unwanted areas/borders in the image, you can crop them by following these steps.

• Open the cropping panel from the «Crop toolbar»

• Select an «aspect ratio» from the drop-down box

• For a desktop wallpaper or a square, «choose 16:9»

• Or you can select the «rectangle»

• Click on «crop selection»

To make your old photo free of spots and noise, you can use the «Spot Remover / Spot and Noise Remover» automatic tool.

Give a smooth look to your old photographs by removing the scratches from it. This can be easily done.

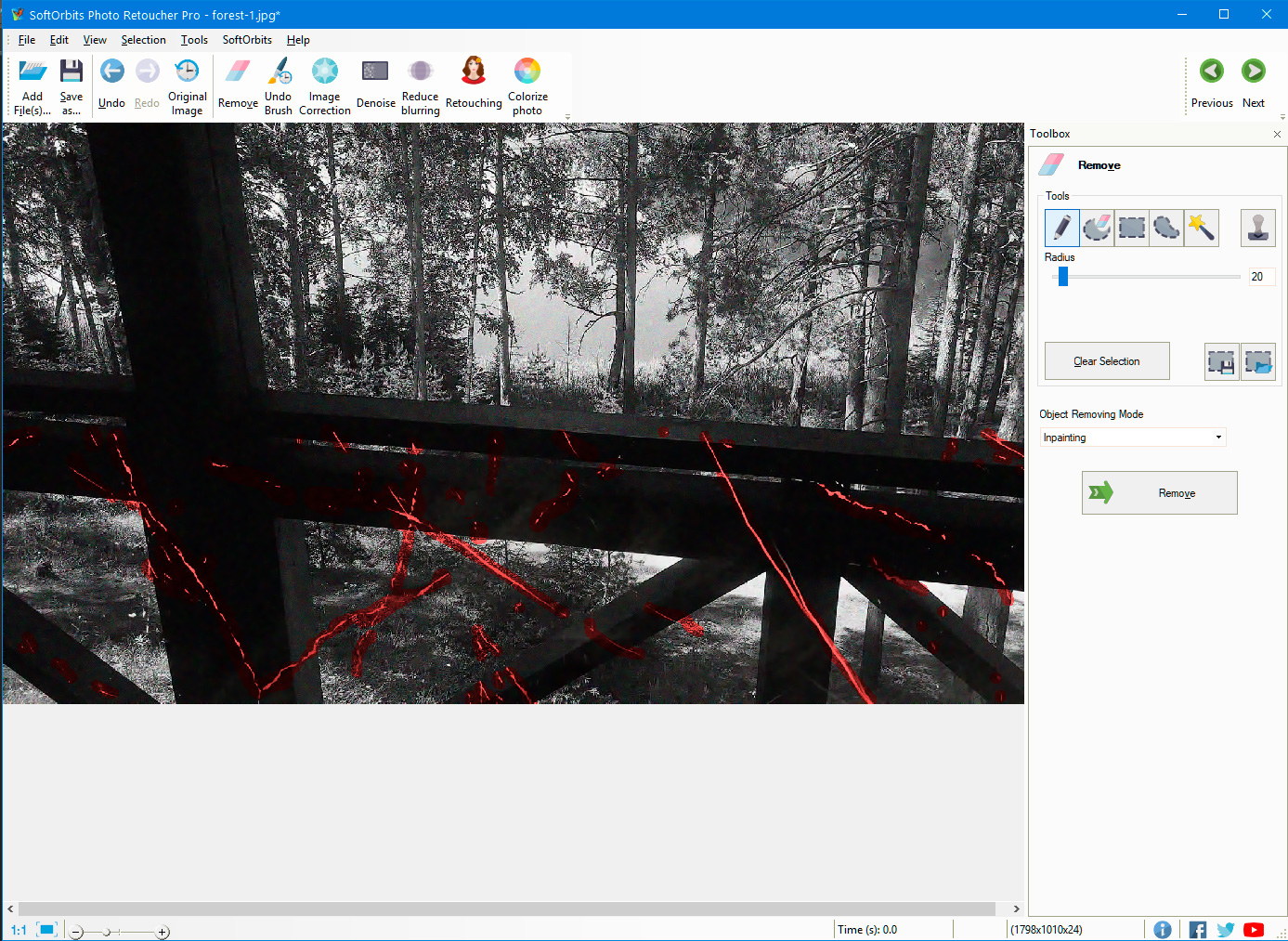

• Click on the «Select Remover Tool»

• Use the «Find Scratches» button to trace the scratches on the image.

• Remove the scratches effortlessly.

• If there are areas that you do not want to select on your picture

• use the «Marker tool» with the «Deselect option» and get rid of these areas.

If you still find your photograph a little imperfect, and want to remove any blemishes or spots or dust, it can be done by using 3 different tools.

• Smudge Tool - This tool can be used to blend or mix an area in the picture.

• Clone Stamp - It will help you to erase objects by painting one image over parts of another image.

• Concealer Tool - This tool can be used to eliminate spots, dust, cracks, etc from your photo.

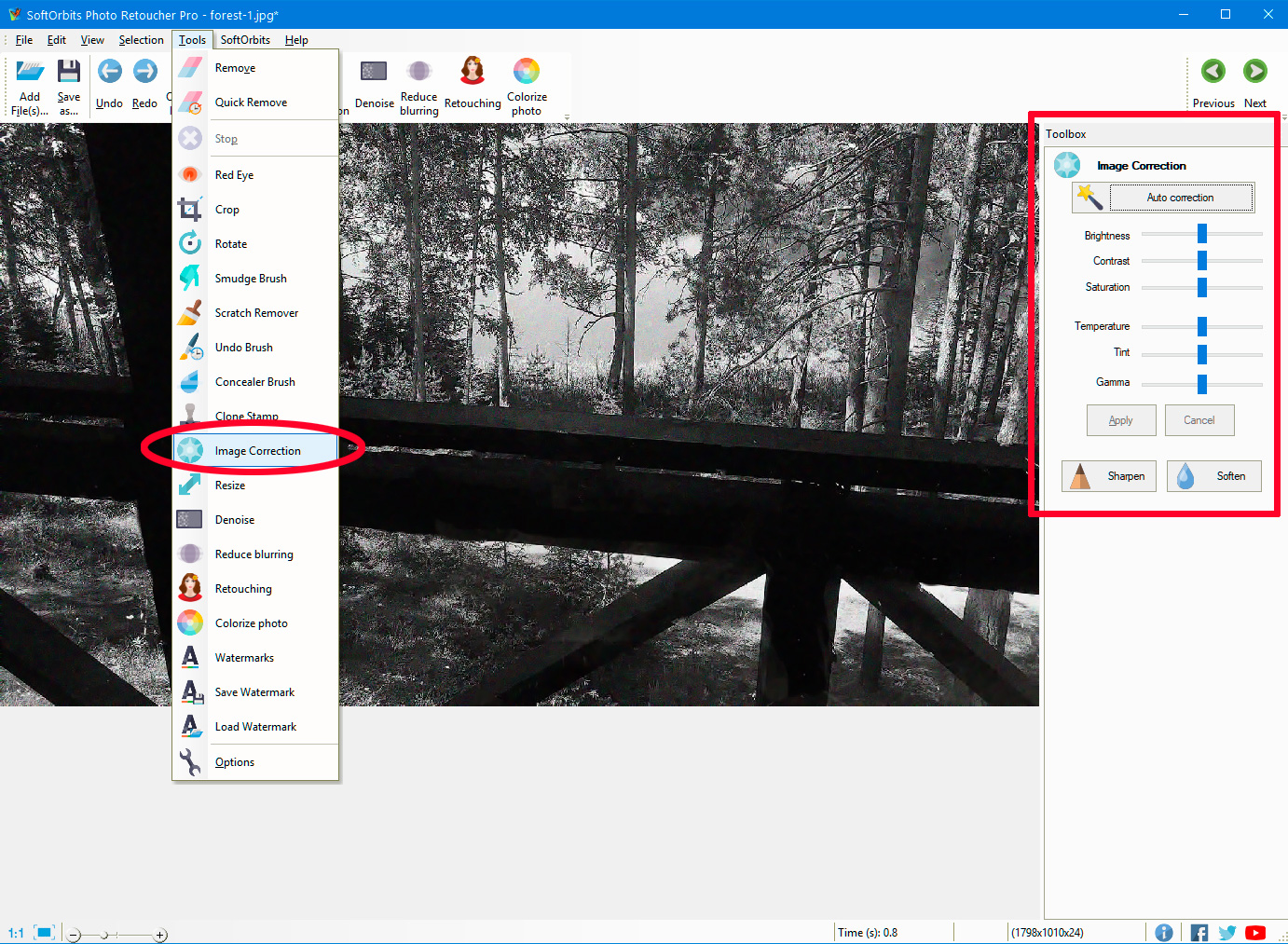

If you feel your photo looks dull or too bright, it can also be adjusted with the «image correction» tool in the software. You can easily set the brightness and contrast until it looks perfect.

The «colorize button» allows you to convert your black and white image into a colorful one.

Now, that you've made all the required edits, and if you're pleased with the final result, click on «Save as» and save the beautiful picture for lifetime in your computer.

This was one of the most convenient ways to make your old pictures look fantastic. But when it comes to editing photos or enhancing images, the first software that comes to our mind is Photoshop.

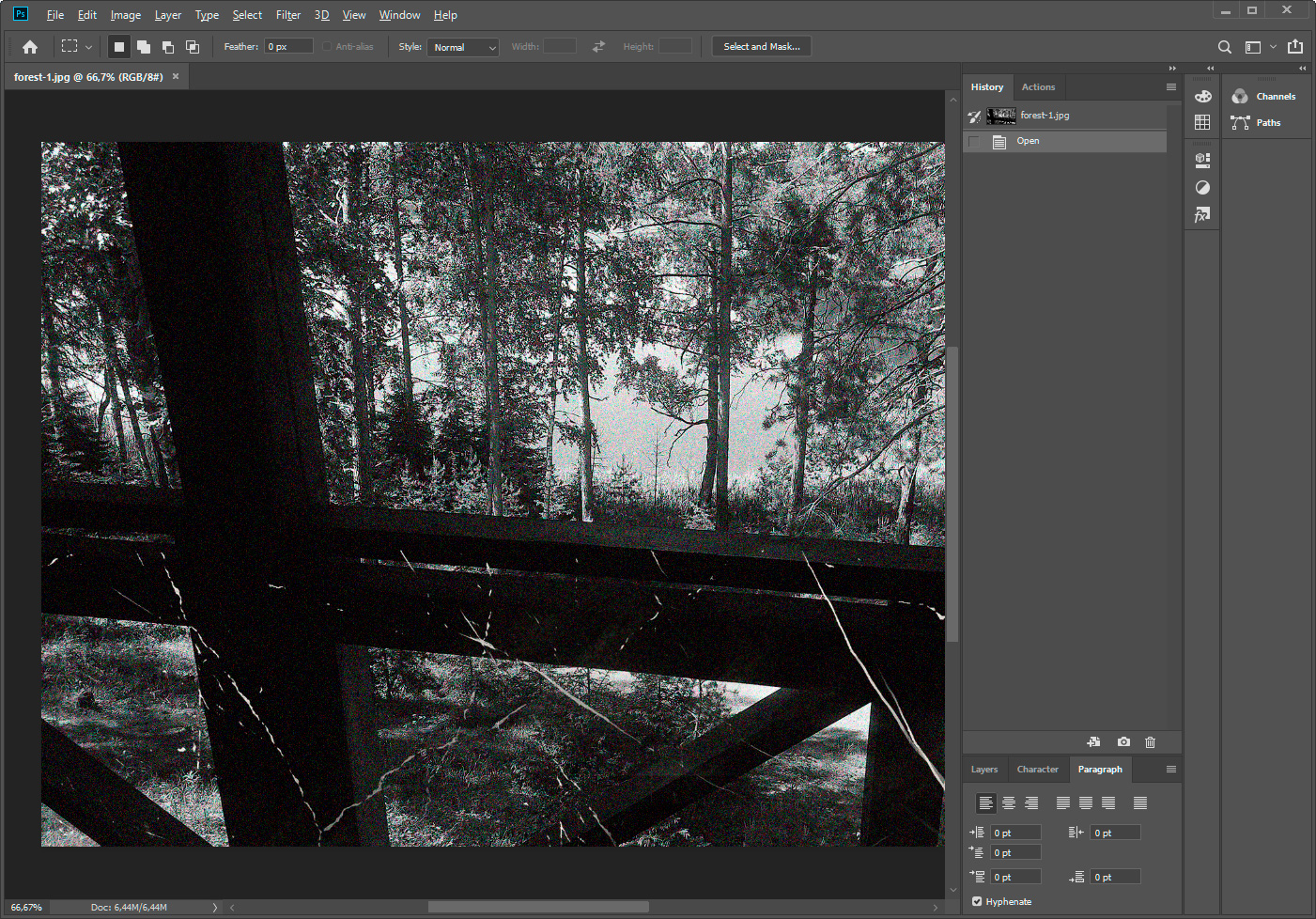

If you want to use Photoshop for photo restoration and retouching, you can have a look at these steps.

No matter what software you use, the first step is to add a digital copy of the photo to the software and crop the unnecessary areas/boundaries of the picture.

After uploading the image to Photoshop, you can use the «crop tool».

• With it you can adjust and resize.

• The image will open in 2 layers.

• One will be the original picture, and the other one, cropped.

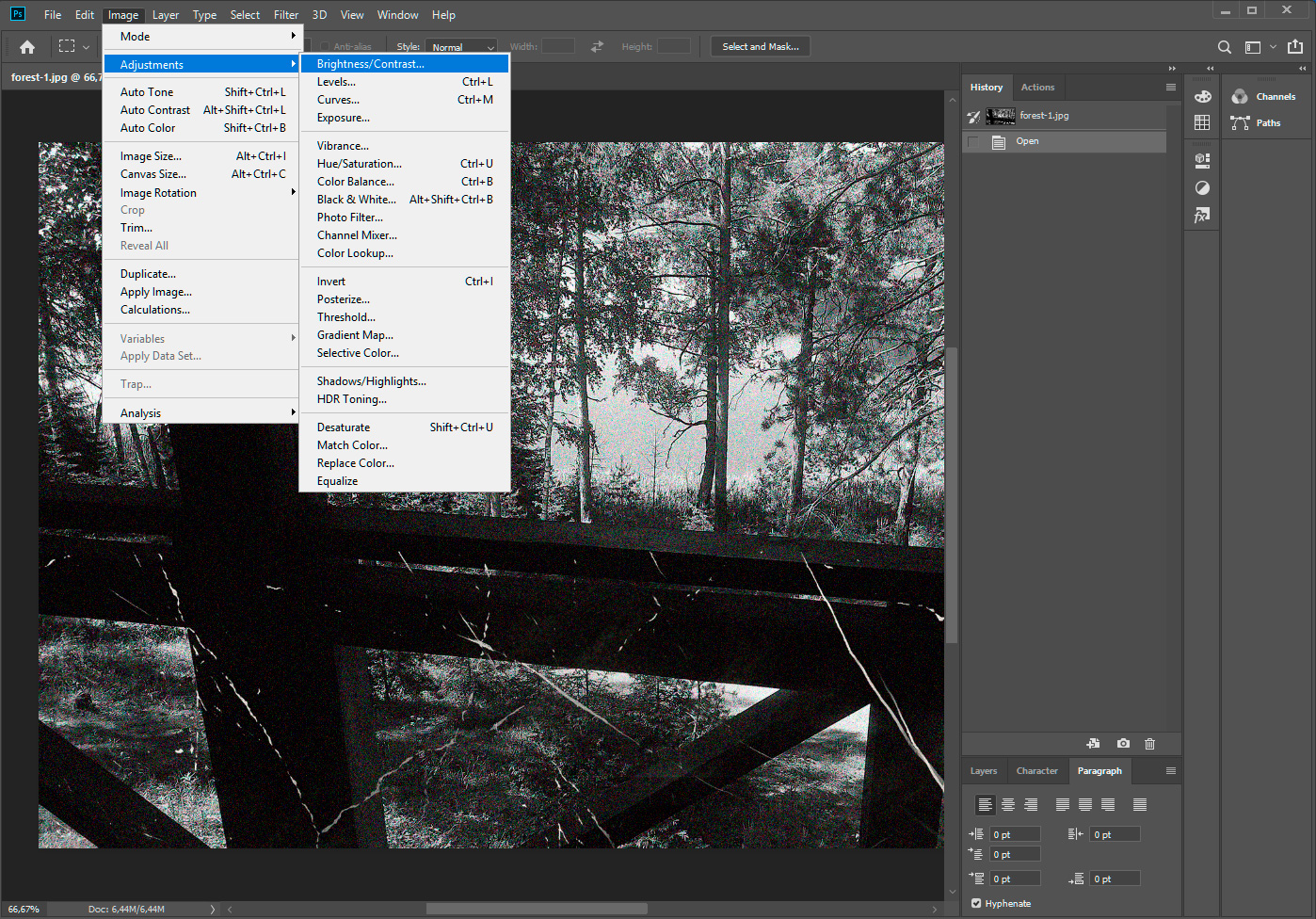

Usually old photos are colorless, but if you want to make changes to the tone, color, contrast, and liveliness of the photo, Photoshop can help you with it, too.

• Click on the «Dropdown» menu.

• Under «Adjustments», choose one of the options from - Auto Tone, Auto Contrast, and Auto Color.

• You can opt for automatic changes or you can also make the changes manually.

For making color changes to your picture, follow these steps.

• Highlight duplicate layer, then click on «Adjustment Layer» under the «Layers Panel»

• Choose the desired levels.

• For making adjustments to your image's RGB (red, green, and blue) levels, click on the focused tab. You will see an RGB menu.

• After clicking on any of the color's options, you can bring the black and white sliders to the histogram's upward line.

• Once the RGB levels are adjusted, exit the Layers Panel.

• For combining both layers, highlight your duplicate layer and your adjustment layer, then right click on the area and select «Merge Layers»

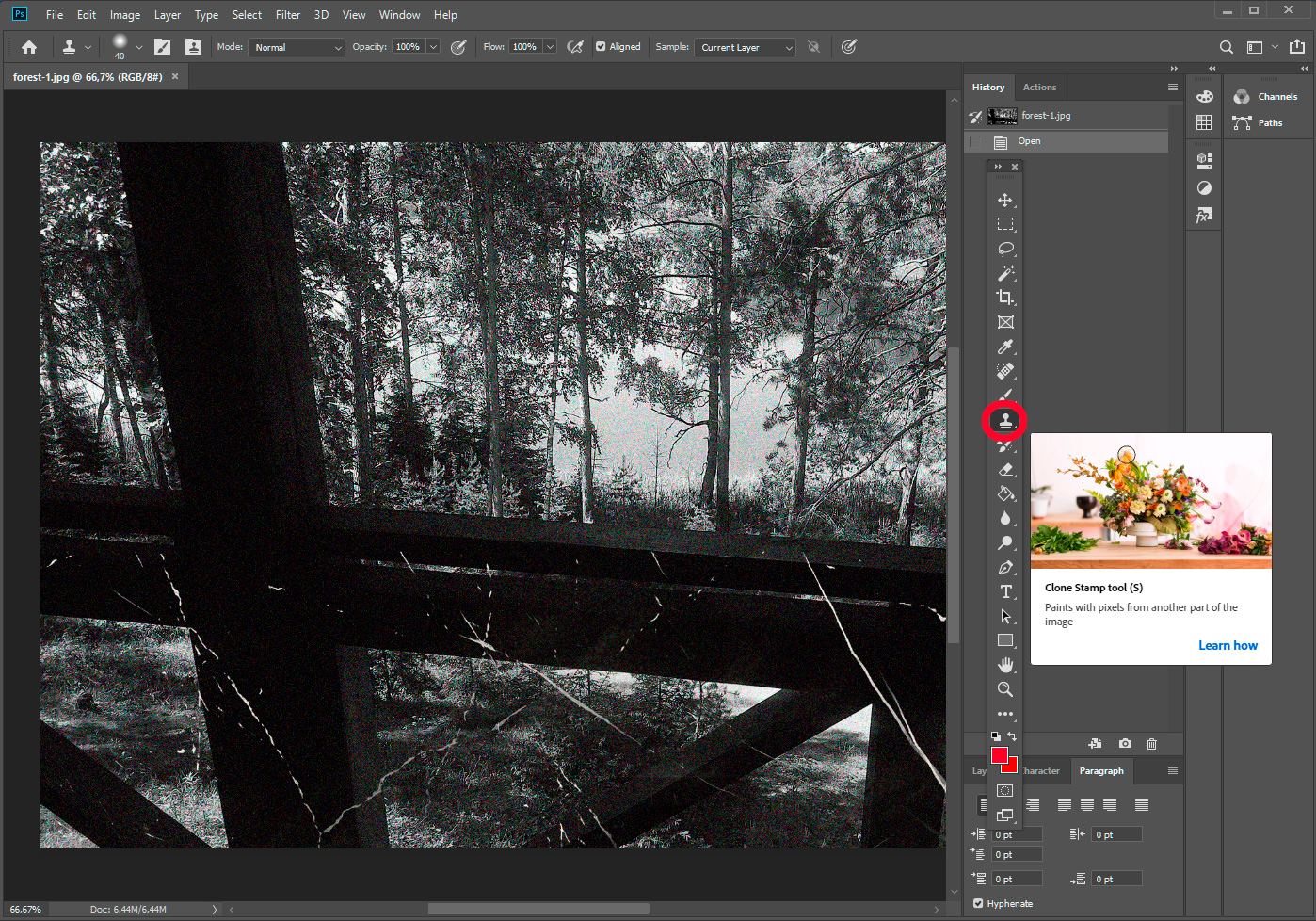

To remove imperfection from your photograph and make it impeccable, you can use the «Clone Stamp» tool.

• In the toolbox, click on the «Clone Stamp» icon.

• Adjust the brush size according to your requirements.

• For specific pixel alignment and layer sampling, set the Aligned or Sample options.

• Use «Alt+Click» or «Option+Click» for the spot you want to clone.

• Drag around the damaged area to «paint» over it with the cloned pixels.

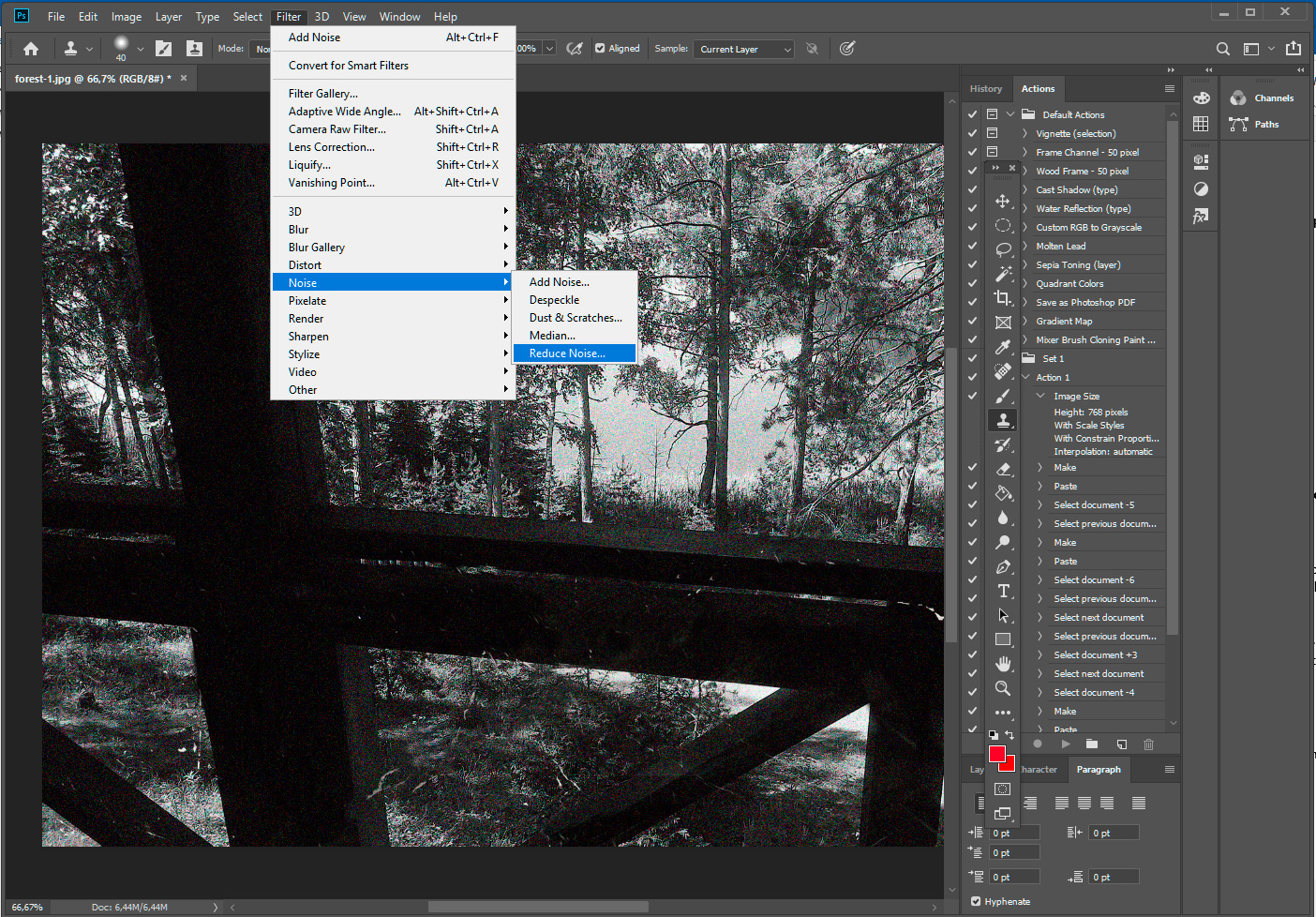

The dust and scratches on your old photo won't disappear themselves, and you can do it manually in Photoshop. Also, you can use the «Filter functions» to reduce some of that unnecessary noise.

• Click on «Filter» in the taskbar.

• Select the «Convert to Smart Filters»

• Go to the Filter tab, and click on «Noise» and then select «Dust & Scratches»

• Slowly increase the «Radius pixels» and «Threshold levels» in intervals until you reach the desired effect. Also, be careful not to overdo it.

• Click OK. Go back to Filter, click on Noise, and then select Reduce Noise.

• Adjust the settings accordingly in the pop-up window, and keep a look at the Preview box to monitor the effect of each adjustment.

Your image is ready!

• Go to Taskbar and click on File, then select Save As.

• From the Format Menus, Choose your preferred file format.

• Add details of your filename and location.

• Click the Save button and save your newly restored photo.

• Keep the spotless, and perfect image with you for a lifetime!

Gone are the days, when restoring an old photo meant that you needed a variety of different equipment, tools, software, lots of money, expertise, etc. With the availability of several software available online, the process has become simpler and most importantly quicker.

Look for a sophisticated tool or software online, and add vibrance and life to your old damaged photos.